ConocoPhillips And Marathon Oil Merger Is A Go... More Long-Term Value Creation

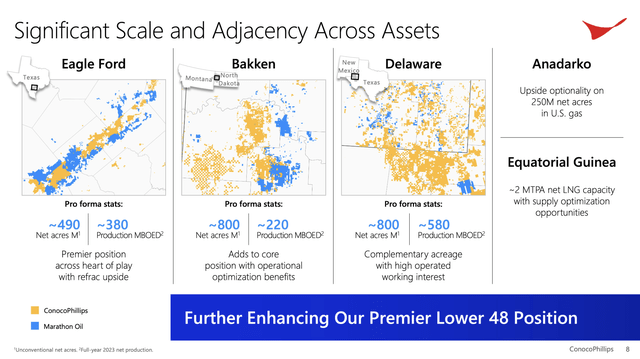

- Absorbing Marathon Oil Corporation into ConocoPhillips produces many operational synergies to improve profitability out of the Eagle Ford and Bakken basins. These basins hold significant refrac potential.

- Marathon investors got a slight bump in valuation through the acquisition but probably not enough to feel satisfied.

- Marathon investors will still benefit through increased dividends, increased share price stability and more efficient operations moving forward.

- The real value for Marathon investors is participation in ConocoPhillips' Willow Project.

JOmcreative/iStock via Getty Images

On August 29th, the acquisition of Marathon Oil Corporation ( NYSE: MRO ) by ConocoPhillips ( NYSE: COP ) was approved by shareholders . The vote cements what is a very attractive and operationally efficient deal for COP. I believe ConocoPhillips' larger size can help optimize MRO's refrac program to extract even more value.

MRO investors may feel like they did not get quite the premium they hoped for considering the historically low valuation of the company. These investors get a few smaller near-term boosts, but I believe the long-term potential lies in future ownership of COP's Willow Project.

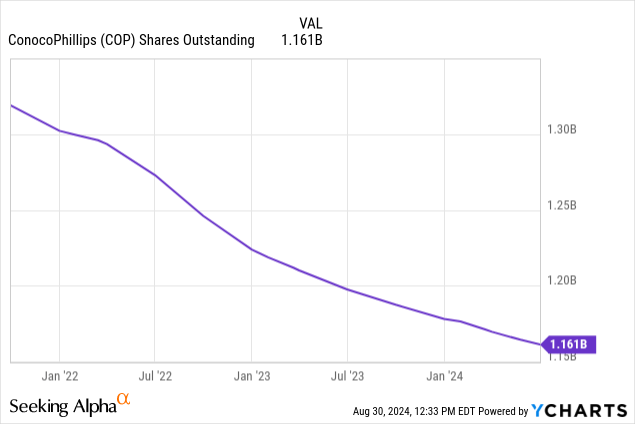

The additional cash flows from the MRO assets allow COP to increase its annual share repurchase target from $5 billion to $7 billion. This allows COP to retire roughly 20% of the outstanding shares before the Willow Project enters operation. This project is expected to produce 180,000 barrels of oil per day and is roughly equivalent to the entire MRO portfolio.

I believe participation in this project allows Marathon Oil Corporation investors to realize more robust long-term gains.

Revisiting The Deal

Before we get too ahead of ourselves, let's refresh ourselves on the details of the deal.

This deal made a ton of sense from an operational standpoint. Two neighbors essentially joined forces to allow for more efficient operations in the Bakken and Eagle Ford basins. This significantly adds to COP's inventory depth in both basins, but only sparsely adds to COP's Permian footprint.

MRO + COP Operational Map (COP Investor Presentation)

Due to the lack of continuous acreage in the Delaware basin, management has indicated these new assets will most likely be used as trade chips to help bolster its core holdings in Reeve's county and southern New Mexico.

Andrew O'Brien - (COP) SVP Strategy - MRO Transaction Announcement

Marathon's acreage will also provide us more opportunities to core up for longer lateral development via swaps and trades, which is something that we do every day.

While operationally this deal appears to be an opportunity for both COP and MRO shareholders, the value of the deal has ruffled a few feathers in the MRO camp. MRO shareholder Martin Siegel filed a lawsuit on August 12th in an attempt to block the merger, claiming that the MRO valuation of $17 billion is significantly undervalued.

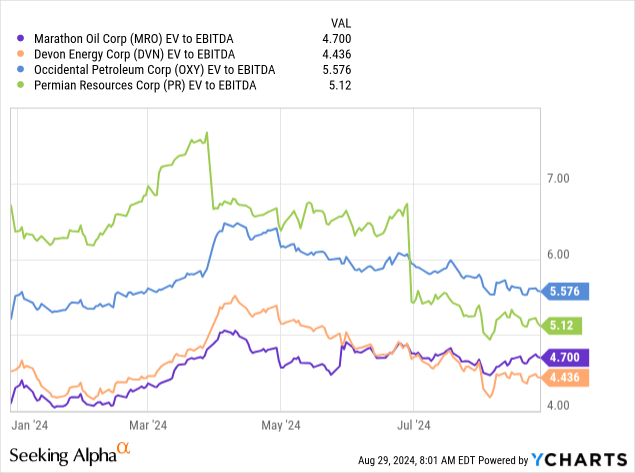

This thought process follows the thesis I outlined in my previous coverage of MRO in March, titled; Marathon Oil: The Price Is Right . In that article, I detailed how MRO was trading discounted to just about every other major oil company by multiple valuation metrics. So, I get where Mr. Siegel is coming from, as I felt the shares were improperly priced.

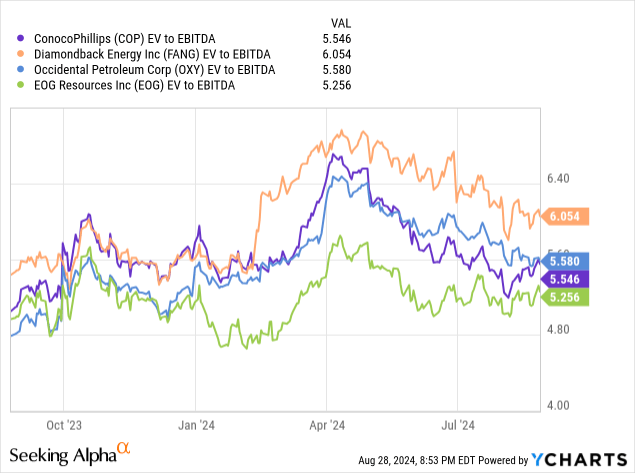

Since the merger announcement , the share price has appreciated up to the deal value, giving investors a 17% gain for those who bought in at that time of my previous analysis. This has allowed the company's EV-to-EBITDA ratio to creep up from 4.3x to 4.7x, partially closing the gap with its comparable market cap peers.

Do The MRO Investors Have A Valid Complaint?

The numbers don't lie, MRO is cheaper than a lot of the other investment options in the oil patch. However, this is mainly associated with its lack of Permian production. Production out of the Permian is what investors want and are willing to pay a premium for it.

In many ways, this is illogical. If company A and company B can make the same rates of returns in two different basins, they should be worth the same (at least in theory). However, we are all familiar that life isn't fair, and rarely do we all act logically. Thus, the cash generated by MRO is deemed to be of lesser quality than its Permian peers.

With its multi-basin approach, COP apparently does not have such restrictive views on the oil market and jumped at the opportunity to add MRO into the fold. The deal allegedly only took a few weeks to develop.

In the end, I think COP got a fantastic deal. MRO investors only got a small boost in value for their position as well as a slightly better dividend in the short term. However, I think COP's larger size will help unlock the value of MRO's acreage at an accelerated rate.

Now let's flip our perspective by sitting at the COP side of the table.

Refracs, Refracs, and More Refracs

Based on the operational maps provided earlier, it's pretty easy to conclude that COP did not buy MRO for its Permian acreage. Its land is too small and sparse to efficiently operate multiple rigs and frac crews.

The upside from MRO's portfolio is its potential for refracs in both the Bakken and Eagle Ford. Both of these basins participated in the original wave of the shale revolution and were mainly developed a decade ago. Since then, completion designs and technology have advanced significantly allowing operators the optionality to go back into older wells, re-stimulate and boost production.

Ryan Lance, COP CEO, gave a description of his vision of refracs in the MRO portfolio during the merger conference call .

we're heading into a period of what I'd call, kind of shale 2.0, which -- it's more about using technology and efficiencies, data analytics and some of the refrac potential that we can get into I'm sure on the call in a little bit, that we see that allows us to extend some Tier 1 inventory, both in the Eagle Ford and the Bakken

Given the sheer size of COP compared to MRO, there should be significantly larger financial resources to invest in refrac R&D to make this technique even more effective over the long run.

Nicholas Olds, COP, EVP of Lower 48, outlined the historical performance of COP's existing refrac program:

we have a long history, as you're aware of, with doing refracs, specifically in Eagle Ford, over 5-plus years and where we see roughly a 60% uplift in expected ultimate recovery. And then we continue to test newer refrac techniques and expand that across the entire Eagle Ford portfolio. And what that is leading to, Roger, is expanding that inventory in our own company. We see very promising opportunity to expand that to Marathon.

Andrew O'Brien, COP, SVP of Strategy also indicated the sheer inventory of refrac candidates in the Marathon portfolio.

In fact, based on our detailed analysis, we believe that Marathon has over 1,000 refrac locations in this Eagle Ford acreage. All totaled, we see over a decade of runway in the Eagle Ford.

ConocoPhillips Is The Bigger Version of MRO

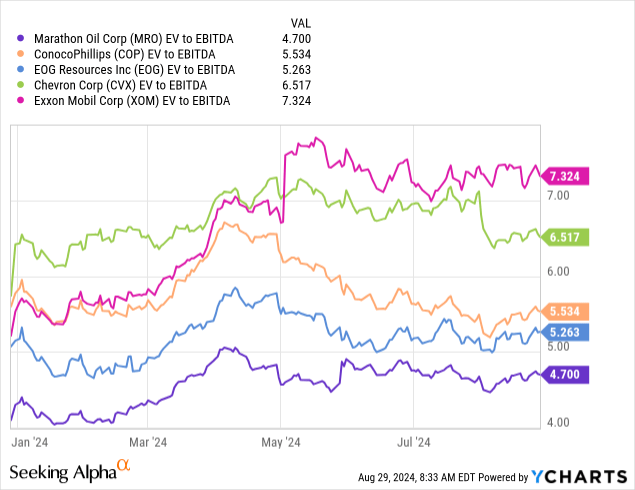

MRO investors may still be feeling a little miffed. However, the existing state of affairs doesn't really change after becoming a COP shareholder. COP trades at a steep discount to its larger peers Exxon Mobil Corporation ( XOM ) and Chevron Corporation ( CVX ).

COP also returns cash to shareholders similarly to MRO. Investors will get a small boost in yield as COP's dividend yields about 2.75%, however, the main form of return is share buybacks. Before the merger, COP committed to buying back $5 billion in stock during 2024. This enables the company to monetize the cheaper valuation of COP's stock.

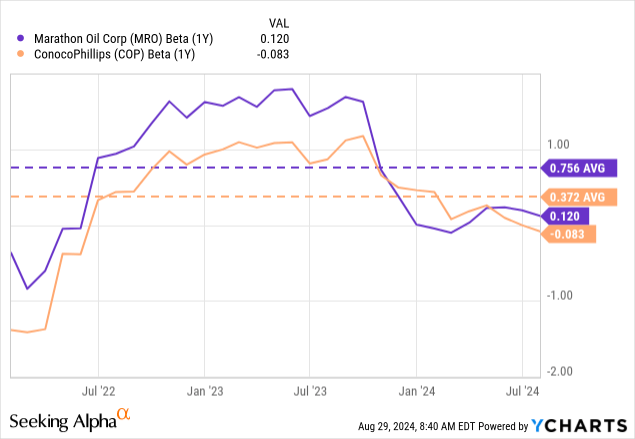

The major difference for MRO investors is that they will enjoy improved share price stability. COP's beta since the beginning of 2022 has averaged 0.372 which points to trading behaviors that are largely uninfluenced by the day-to-day fluctuations in the market. This is less than half of MRO's beta during the same period.

To me, COP suffers from some of the same reasons why MRO was treated with a lower valuation than many other companies.

1. It's not a household name in the same way that Exxon Mobil and Chevron are.

2. Its domestic portfolio is not 100% focused on the Permian.

3. It lacks any big splash offshore projects like Guyana.

This causes COP to trade more in line with smaller companies, often not recognizing the benefits of COP's scale.

As a result of this undervaluation, the bulk of the company's cash returns to shareholders is in the form of stock buybacks. When the MRO transaction closes in the 4th quarter, the company plans to increase its annual stock repurchase budget from $5 million to $7 million. This supports the company's goal to retire the newly issued shares for the merger in just three years.

In the near term, COP will be accelerating its share repurchase program through the end of 2024 to meet its stated goals. COP has been restricted from buying back shares since May 29th, until the shareholder vote was completed. Now that this covenant has been lifted, I expect the rapid increase in buyback frequency will provide near-term support for the stock.

In the Q2 conference call the CFO provided the following guidance for buybacks through the end of the year.

Once the Marathon shareholder votes complete, you should expect us to be leaning into buybacks. And we think that's really important because we've consistently been one of our largest buyers of stock every quarter. And you can run the math on that. It's pretty straightforward. That's at least $3 billion of buybacks that you should expect in the -- through the third and fourth quarter.

Should MRO Investors Stay On Board?

The COP transaction is not a monumental shift for long-time MRO investors. The move modestly improves the yield by about 1% and also provides for a more stable investment. Over the long haul, COP has the financial resources to accelerate the development of the current MRO acreage.

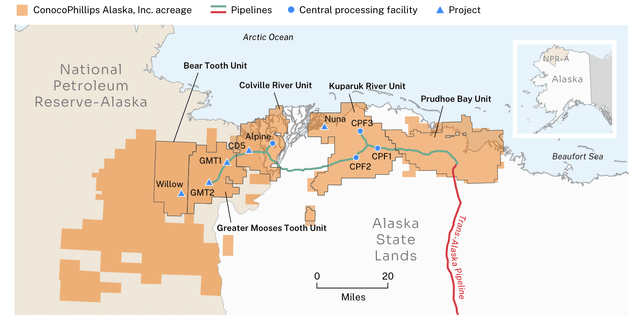

MRO investors also get the opportunity to participate in COP's Willow Project in Alaska, which is projected to produce 180,000 barrels of oil at peak production. This project's capacity is nearly equivalent to the entire production of the current MRO portfolio and is a significant needle mover for COP. However, this project will not be complete until 2029.

The heavy share repurchase activity projected by COP stands to meaningfully reduce the total share count by the time this project enters service. Therefore, I believe MRO investors will be rewarded for their continued long-term patience. At the state's pace of $7 billion in annual share repurchases, roughly 20% of the outstanding shares (including those to be issued to MRO) could be retired before Willow entered service.

At that time, production (and profitability) should show a step change upward against a declining share count.

COP Alaskan Operational Map (ConocoPhillips)

As with any energy company, the stock's performance and risks are closely tied to commodity prices. However, I believe COP's size helps dampen some extreme price swings that MRO investors have experienced in the past. This is shown by the difference in the two companies' beta performance.

The flip side to COP's size advantage is the capital risk associated with large projects such as Willow. With a total capital budget of $11-$11.5 billion located in the National Petroleum Reserve, political and governmental changes could severely affect the timeline and budget of this project.

I also expect that COP will find difficulty developing multiple expansion until this project is closer to completion and develops more certainty.

Key Takeaways

1. Absorbing MRO into COP produces many operational synergies to improve profitability out of the Eagle Ford and Bakken basins.

2. MRO investors got a slight bump in valuation through the acquisition but probably not enough to feel satisfied.

3. MRO investors will still benefit through increased dividends, increased share price stability, and more efficient operations moving forward.

4. COP's Willow Project provides large upside for those that are willing to wait for the project to come online. The target rate of $7 billion in annual share repurchases stands to retire roughly 20% of the outstanding shares before Willow comes online.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About mro stock.

| Symbol | Last Price | % Chg |

|---|

More on MRO

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| COP | - | - |

| MRO | - | - |

Trending Analysis

Trending news.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

A Dissertation Report On Merger and Acquisition in India

Related Papers

Ikechukwu Acha

Azeem ahmad khan

In this paper, the researcher studies the Impact of Mergers on Shareholders Wealth in the Indian banking industry. The sample comprised of five mergers in the Indian banking sector; the mergers taking place from 20, Nov 2002 to 19 May 2010. All the Targets and Acquiring banks are traded on the BSE 500. In order to find out the impact of Mergers on the shareholder's wealth the researchers used the Standard Risk Adjusted Event Methodology. After testing, the study showed that the expectations of shareholders of Target and Bidder banks to avail the excess return could not be realized with public information and they were unable to earn abnormal return neither before nor after the announcement of M&A's. The announcement of merger for both the bidder and the target is statistically insignificant and economically relevant.

Sony Parackal

Consolidation of banks through mergers and acquisitions is an important force of change taking place in the Indian banking sector. The present work investigates the fairness of valuation in bank merger deals occurred in the post-liberalization India. In contrast to the firm valuation which gives an absolute value, merger valuation is a relative valuation which is very important for both bidder and target banks. In other words, the exchange ratios fixed in the deals are very crucial as it will have a major impact on the future prospects of the acquiring bank. To check the authenticity or fairness of valuation, the study uses contribution analysis in two different ways. When the absolute ratios are considered, the deals appear more favourable to the targets as the deal values were very higher to their market capitalization. However, the study finds that target banks got underpaid and the significant increase in the share prices of target banks around the merger announcement cannot be attributed to the valuation aspects. The study is completely based on the financials of banks at the time of merger and other factors including the strategic benefits to both bidder and target banks are ignored.

International Journal of Financial Services Management

Rudra Sensarma

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

300+ Shodhganga Research Topics For all Subjects and Students

Research is the cornerstone of academic growth, driving innovation and fostering understanding across various disciplines. Shodhganga, India’s premier digital repository for doctoral theses and dissertations, serves as a vast resource for scholars across diverse fields such as science, technology, social sciences, humanities, and more. With numerous topics ranging from artificial intelligence to gender studies, Shodhganga empowers researchers to contribute to academic and societal progress.

Table of Contents

Also See: 120+ Consumer Behavior Research Topics For Students

By offering access to groundbreaking research, it helps bridge knowledge gaps, encourages interdisciplinary collaboration, and supports India’s educational development, fostering a vibrant culture of inquiry and intellectual growth.

Science and Technology

1.1 Computer Science and Information Technology

- Blockchain technology and its applications in cybersecurity.

- Artificial intelligence for healthcare diagnostics.

- Quantum computing algorithms.

- Data mining techniques for big data.

- Internet of Things (IoT) in smart cities.

- Cloud computing security challenges.

- Machine learning in autonomous vehicles.

- Natural language processing for sentiment analysis.

- Cybersecurity in financial technologies.

- Virtual reality for educational applications.

1.2 Electronics and Communication Engineering

- 5G networks and beyond.

- Signal processing in biomedical applications.

- Antenna design for wireless communications.

- AI in image and video processing.

- Green communications technologies.

- Photonic devices for high-speed communication.

- Wearable electronics for health monitoring.

- Wireless sensor networks in disaster management.

- VLSI design for low-power applications.

- Optical fiber communications.

1.3 Electrical Engineering

- Renewable energy systems integration.

- Smart grid technologies and their challenges.

- Electric vehicle powertrain systems.

- Energy-efficient electric motors.

- Power quality improvement in distribution networks.

- Microgrids and their applications.

- Optimization in power system planning.

- Wireless power transfer technology.

- High-voltage DC transmission systems.

- Battery management systems for electric vehicles.

1.4 Mechanical Engineering

- Robotics in industrial automation.

- 3D printing and additive manufacturing in aerospace.

- Nanomaterials for mechanical applications.

- Smart materials in mechanical systems.

- Fluid dynamics in renewable energy.

- Sustainable manufacturing techniques.

- Thermal management in electric vehicles.

- AI in predictive maintenance of machines.

- Composite materials for lightweight structures.

- Tribology in high-performance systems.

1.5 Civil Engineering

- Earthquake-resistant building designs.

- Green building materials and technologies.

- Wastewater treatment techniques.

- Smart cities and their infrastructure challenges.

- Sustainable transportation systems.

- Geotechnical challenges in infrastructure development.

- Urban planning for disaster resilience.

- Performance of sustainable concrete materials.

- Environmental impact of construction activities.

- Coastal engineering for climate change mitigation.

1.6 Biotechnology

- CRISPR technology in gene editing.

- Microbial fuel cells for energy production.

- Stem cell therapy for regenerative medicine.

- Nanobiotechnology in drug delivery.

- Bioremediation of environmental pollutants.

- Plant tissue culture techniques for crop improvement.

- Bioinformatics in personalized medicine.

- Metagenomics for microbial diversity exploration.

- Genomics of rare diseases.

- Bioplastic production using algae.

Also See: 50 Research Paper Topics For Mca Students

Social Sciences

2.1 Sociology

- Impact of urbanization on rural communities.

- Gender inequality in the workplace.

- Role of social media in shaping public opinion.

- Child labor and education access in developing countries.

- Migration and its impact on social structures.

- Aging population and healthcare needs.

- Women empowerment through education.

- Role of NGOs in social development.

- Caste dynamics in modern India.

- Changing family structures in urban societies.

2.2 Economics

- Behavioral economics and decision-making.

- Impact of demonetization on the Indian economy.

- Microfinance and its role in poverty alleviation.

- Economic impact of COVID-19 on global trade.

- Financial inclusion in developing countries.

- Sustainable economic development models.

- Impact of foreign direct investment on economic growth.

- Role of digital currencies in modern economies.

- Economic analysis of renewable energy policies.

- Public policy and its impact on income inequality.

2.3 Political Science

- Governance models in federal systems.

- Role of international organizations in global peace.

- Political reforms in developing democracies.

- Social media’s role in political mobilization.

- Public policy formulation in India.

- Challenges in implementing e-governance.

- Electoral reforms in India.

- Impact of regionalism on national politics.

- Political leadership in times of crisis.

- Nationalism and its influence on foreign policy.

2.4 Psychology

- Cognitive development in early childhood.

- Impact of social media on mental health.

- Stress management techniques in modern workplaces.

- Psychological impact of natural disasters.

- Emotional intelligence and its role in leadership.

- Role of family in child behavioral development.

- Treatment approaches for post-traumatic stress disorder.

- Role of community support in mental well-being.

- Cross-cultural studies on personality traits.

- Role of mindfulness in stress reduction.

Also See: General Presentation Topics

3.1 Literature

- Postcolonial literature and identity.

- Feminism in contemporary Indian literature.

- Translation studies in multilingual societies.

- Representation of marginalized voices in literature.

- Impact of globalization on regional literature.

- Comparative analysis of Indian and Western classical literature.

- Eco-criticism in 21st-century literature.

- Mythological themes in modern Indian literature.

- Literature and its role in social activism.

- Exploration of dystopian themes in contemporary novels.

3.2 History

- Role of women in India’s independence movement.

- Ancient trade routes and their economic impact.

- The Mughal Empire’s contribution to Indian architecture.

- Colonialism’s impact on Indian education systems.

- The history of Indian classical music.

- Influence of Buddhism on early Indian societies.

- Evolution of regional languages in India.

- The political landscape of India post-independence.

- Tribal societies in ancient India.

- The socio-economic structure of medieval India.

3.3 Philosophy

- Ethics of artificial intelligence in modern societies.

- The philosophy of non-violence in Gandhian thought.

- Existentialism and its relevance today.

- The role of meditation in philosophical inquiry.

- Ethics of environmental responsibility.

- Philosophy of mind and consciousness studies.

- Comparative analysis of Indian and Western philosophical thought.

- The philosophy of democracy in contemporary India.

- Moral relativism in multicultural societies.

- Role of philosophy in education systems.

Management and Commerce

4.1 Business Management

- Strategic management in the digital age.

- Corporate social responsibility and its impact on branding.

- E-commerce and its effect on traditional retail.

- Role of AI in supply chain management.

- Leadership styles in a globalized world.

- Innovation management in tech startups.

- Customer relationship management in the digital era.

- Impact of globalization on small and medium enterprises.

- Crisis management in multinational corporations.

- Role of data analytics in business decision-making.

4.2 Finance

- Risk management in financial markets.

- The role of fintech in financial inclusion.

- Impact of digital banking on consumer behavior.

- Role of cryptocurrencies in modern economies.

- Behavioral finance and investor decision-making.

- Corporate governance in emerging economies.

- Microfinance institutions and their sustainability.

- Impact of mergers and acquisitions on stock markets.

- Financial literacy and its impact on economic growth.

- Challenges in sustainable investing.

Also See: Non Technical Topics

Health Sciences

5.1 Medicine

- Impact of lifestyle diseases on healthcare systems.

- Role of telemedicine in rural healthcare access.

- Personalized medicine in cancer treatment.

- Public health challenges in pandemic management.

- AI in medical diagnostics and treatment planning.

- Role of genetics in disease prevention.

- Mental health challenges in urban populations.

- Comparative study of traditional and modern medicine.

- Role of nutrition in chronic disease management.

- Healthcare systems in post-pandemic world.

5.2 Public Health

- Immunization programs in developing countries.

- Waterborne diseases and their prevention strategies.

- Mental health policies in public healthcare systems.

- Impact of healthcare privatization on quality of care.

- Role of community health workers in primary care.

- Health disparities in marginalized communities.

- Occupational health and safety in industrial sectors.

- Public health approaches to controlling epidemics.

- Role of technology in improving public health services.

- Health education campaigns and their effectiveness.

Environmental Sciences

- Impact of climate change on biodiversity.

- Sustainable agriculture practices.

- Role of renewable energy in reducing carbon emissions.

- Environmental policies and their impact on conservation.

- Waste management in urban areas.

- Deforestation and its ecological consequences.

- Role of indigenous knowledge in environmental conservation.

- Water resource management in drought-prone regions.

- Pollution control measures in industrial areas.

- Environmental justice and its importance in policy-making.

Also See: Corporate Law Research Topics For Students

- Cybercrime and its legal implications.

- Intellectual property rights in the digital age.

- Environmental law and policy enforcement.

- Human rights violations and international law.

- Legal challenges in e-commerce transactions.

- Role of the judiciary in protecting civil liberties.

- Constitutional law and social justice.

- International trade laws and their impact on national economies.

- Corporate law and its role in business ethics.

- Gender-based violence and legal reforms.

- Inclusive education for differently-abled students.

- Role of technology in transforming classroom learning.

- Teacher education and professional development.

- Impact of online learning on student performance.

- Curriculum design for skill-based education.

- Education policies and their impact on rural areas.

- Role of parental involvement in child’s academic success.

- Gender disparity in higher education.

- Educational leadership in the 21st century.

- Role of vocational education in skill development.

Also See: CSE Seminar Topics

Shodhganga plays a crucial role in advancing research by offering a platform for scholars to share and access knowledge. With a diverse range of research topics, it supports academic growth, fosters innovation, and strengthens the educational framework, making significant contributions to India’s intellectual and societal progress.

Related Posts

310 psychology research topics all school college students, 50 corporate law research topics for students, 120+ consumer behavior research topics for students, 50 research paper topics for mca students, no comments yet, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- My Shodhganga

- Receive email updates

- Edit Profile

Shodhganga : a reservoir of Indian theses @ INFLIBNET

- Shodhganga@INFLIBNET

- Gauhati University

- Department of Law

| DC Field | Value | Language |

|---|---|---|

| dc.coverage.spatial | Law | |

| dc.date.accessioned | 2016-01-04T05:36:24Z | - |

| dc.date.available | 2016-01-04T05:36:24Z | - |

| dc.identifier.uri | http://hdl.handle.net/10603/66523 | - |

| dc.description.abstract | Abstract not available | |

| dc.format.extent | ||

| dc.language | English | |

| dc.relation | ||

| dc.rights | university | |

| dc.title | A critique of the Assam land and revenue regulation 1886 | |

| dc.title.alternative | ||

| dc.creator.researcher | Deka, Nalini Kanta | |

| dc.subject.keyword | Acquisition | |

| dc.subject.keyword | Administration | |

| dc.subject.keyword | Critique | |

| dc.subject.keyword | Land | |

| dc.subject.keyword | Registration | |

| dc.subject.keyword | Regulation | |

| dc.subject.keyword | Revenue | |

| dc.subject.keyword | Settlement | |

| dc.description.note | Data not available | |

| dc.contributor.guide | Hussain, A | |

| dc.publisher.place | Guwahati | |

| dc.publisher.university | Gauhati University | |

| dc.publisher.institution | Department of Law | |

| dc.date.registered | n.d. | |

| dc.date.completed | 30/06/1989 | |

| dc.date.awarded | n.d. | |

| dc.format.dimensions | ||

| dc.format.accompanyingmaterial | None | |

| dc.source.university | University | |

| dc.type.degree | Ph.D. | |

| Appears in Departments: |

| File | Description | Size | Format | |

|---|---|---|---|---|

| Attached File | 32.73 kB | Adobe PDF | ||

| 35.29 kB | Adobe PDF | |||

| 77.66 kB | Adobe PDF | |||

| 89 kB | Adobe PDF | |||

| 272.97 kB | Adobe PDF | |||

| 744.25 kB | Adobe PDF | |||

| 619.18 kB | Adobe PDF | |||

| 969.87 kB | Adobe PDF | |||

| 395.27 kB | Adobe PDF | |||

| 1.15 MB | Adobe PDF | |||

| 882.06 kB | Adobe PDF | |||

| 692.76 kB | Adobe PDF | |||

| 759.99 kB | Adobe PDF | |||

| 291.09 kB | Adobe PDF | |||

| 358.13 kB | Adobe PDF | |||

| 658.9 kB | Adobe PDF | |||

| 233.37 kB | Adobe PDF | |||

| 422.07 kB | Adobe PDF | |||

| 447.87 kB | Adobe PDF | |||

| 421.61 kB | Adobe PDF | |||

| 232.55 kB | Adobe PDF | |||

| 617.4 kB | Adobe PDF | |||

| 1.6 MB | Adobe PDF | |||

| 43.73 kB | Adobe PDF | |||

| 19.69 kB | Adobe PDF | |||

| 40.61 kB | Adobe PDF | |||

| 61.98 kB | Adobe PDF | |||

| 24.05 kB | Adobe PDF | |||

| 32.88 kB | Adobe PDF | |||

| 347.08 kB | Adobe PDF |

Items in Shodhganga are licensed under Creative Commons Licence Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

IMAGES

VIDEO

COMMENTS

In the globalized economy Merger and Acquisitions acts as an important tool for the growth and expansion of the economy. Merger is a combination of two or more companies through the pooling of interests. The name of the company after merger can be a new company name or follow either buyer or the seller company name.

The Shodhganga@INFLIBNET Centre provides a platform for research students to deposit their Ph.D. theses and make it available to the entire scholarly community in open access. Shodhganga@INFLIBNET. V. B. S. Purvanchal University. Department of Commerce.

Shodhganga. The Shodhganga@INFLIBNET Centre provides a platform for research students to deposit their Ph.D. theses and make it available to the entire scholarly community in open access. this thesis, we focus on different dimensions related to mergers and acquisitions. In the first chapter, we introduce the inter linkages between the mergers ...

W eston et al. (2011) have explained the theories of. mergers and tender offers based on three aspects namely. (1) the reason behind occurrence of a merger, (2) the. expected impact of mergers and ...

This article is an attempt to investigate the impact of mergers and acquisitions (M&As) on corporate performance of Indian IT sector for the period 2007-2015. The focus of this article is on Indian IT sector as it has been the growth engine of the economy and emerging as its most internationalised sector. This article has engaged, fixed and ...

Merger and Acquisition announced by the Government of India in the banking sector. For this purpose, the study has taken into consideration five variables for the comparative analysis ca. ital, business, advances, deposit and net profit in the pre and post M&A of banks. The conclusion of study witn.

Thesis On August 29th, the acquisition of Marathon Oil Corporation ( NYSE: MRO ) by ConocoPhillips ( NYSE: COP ) was approved by shareholders . The vote cements what is a very attractive and ...

DECLARATION I, NADEER P, do hereby declare that this thesis entitled "IMPACT OF MERGER AND ACQUISITION ON SHAREHOLDERS' WEALTH AND CORPORATE PERFORMANCE" is a bonafide record of research work done by

- 255 - GROWTH AND UTILISATION OF SHODHGANGA 2. Objective The main objectives of the paper is as follows - To know the shodhganga uses pattern since its inception. To know what the regions are involved worldwide and within India. To know yearly update of theses and dissertations. Text analysis of the titles to understand the growth of topics, topic modelling of the documents,

Stavenuiter, Nick. (2024, July 2). Information Asymmetry in Mergers and Acquisitions: Environmental signals in M&A markets.Strategic Management.

It was witnessed in the past that banks have faced acute financial crisis. Such crisis endangered the sustainability of the bank. In the remedy, Government tried to recapitalise the bank and also used merger as a survival strategy in Indian banking sector. Sick bank was snowballed to amalgamate with the high performed bank. newline: Pagination ...

The study covers a comprehensive analysis on mergers and acquisitions, by analysing them from three angles. The first angle attempts to find out the impact of merger and acquisitions on the financial performance of selected companies who have undertaken mergers and acquisitions during the years of 2000 to 2012.

In this paper, the researcher studies the Impact of Mergers on Shareholders Wealth in the Indian banking industry. The sample comprised of five mergers in the Indian banking sector; the mergers taking place from 20, Nov 2002 to 19 May 2010. All the Targets and Acquiring banks are traded on the BSE 500. In order to find out the impact of Mergers ...

the phase of consolidation amongst banks in future. Key words: Merge. ns, Banking sector, financial variables.INTRODUCTIONMergers and Acquisitions are considered as a relatively fast and efficient approach to exp. nd into new markets and incorporate new technologies. The main aim behind used strategy by firms is to stre.

In the third study (chapter 4), the impact of withdrawn or failed mergers and acquisitions on M&A short-term performance is investigated by exploring deal completion status on cumulative abnormal return on different time windows using a sample of 952 US publicly listed companies from 1995 to 2019.

PDF | On Jun 1, 2020, Alex Borodin and others published Impact of mergers and acquisitions on companies' financial performance | Find, read and cite all the research you need on ResearchGate

Chapter 1 Thesis Introduction Mergers and acquisition (M&A) are an important and popular topic in the finance area. A merger usually describes the process of two or more companies being combined, with the assets and liabilities of the selling firm being absorbed by the buying firm. An acquisition

Shodhganga: a reservoir of Indian theses @ INFLIBNET ... The research assesses the success or failure of Indian firms involved in merger or an acquisition deal. The thesis is important as it fills the gap in the literature in which it examines the aggregate performance, performance across different sectors and also looks into firm specific ...

Bachelor Thesis Economics and Business Economics Financial Accounting A Literature Review on Mergers and Acquisitions Joep D. Hijmans 381522 28 July 2022 Abstract Using prior academic literature, this thesis gathers and combines information on mergers and acquisitions (M&A) to provide a better understanding of this topic.

an acquisition refers to the takeover of one entity by another. Mergers and acquisitions may be completed to expand a company's reach or gain market share in an attempt to create shareholder value. VIII. FIVE BIGGEST MERGERS AND ACQUISITIONS IN INDIA 1. ARCELOR MITTAL The biggest merger valued at $38.3 billion was also one that was the most ...

Shodhganga: a reservoir of Indian theses @ INFLIBNET ... Mergers and Acquisitions In Indian Banking Industry An Analytical Study of Pre and Post Merger Performance: Researcher: Dwivedi, Rashmi: Guide(s): Srivastava, Deepa: Keywords: Business Economics and Business

Impact of mergers and acquisitions on stock markets. Financial literacy and its impact on economic growth. Challenges in sustainable investing. Also See: Non Technical Topics. Health Sciences; 5.1 Medicine. Impact of lifestyle diseases on healthcare systems. Role of telemedicine in rural healthcare access. Personalized medicine in cancer treatment.

Shodhganga: a reservoir of Indian theses @ INFLIBNET The Shodhganga@INFLIBNET Centre provides a platform for research students to deposit their Ph.D. theses and make it available to the entire scholarly community in open access. ... Acquisition: dc.subject.keyword: Administration: dc.subject.keyword: Critique: dc.subject.keyword:

This work analyses the motivation of mergers in general and its effects on the automobile industry in particular. This work analyses the motivation of international merger and its effects on the world automobile industry. Effectively, this work explores how Daimler-Benz and Chrysler Corporation merged in 1998 Characteristics of an acquiring company and a target company Motivation of ...