- Andhra Pradesh

- Chhattisgarh

- West Bengal

- Madhya Pradesh

- Maharashtra

- Jammu & Kashmir

- NCERT Books 2022-23

- NCERT Solutions

- NCERT Notes

- NCERT Exemplar Books

- NCERT Exemplar Solution

- States UT Book

- School Kits & Lab Manual

- NCERT Books 2021-22

- NCERT Books 2020-21

- NCERT Book 2019-2020

- NCERT Book 2015-2016

- RD Sharma Solution

- TS Grewal Solution

- TR Jain Solution

- Selina Solution

- Frank Solution

- Lakhmir Singh and Manjit Kaur Solution

- I.E.Irodov solutions

- ICSE - Goyal Brothers Park

- ICSE - Dorothy M. Noronhe

- Micheal Vaz Solution

- S.S. Krotov Solution

- Evergreen Science

- KC Sinha Solution

- ICSE - ISC Jayanti Sengupta, Oxford

- ICSE Focus on History

- ICSE GeoGraphy Voyage

- ICSE Hindi Solution

- ICSE Treasure Trove Solution

- Thomas & Finney Solution

- SL Loney Solution

- SB Mathur Solution

- P Bahadur Solution

- Narendra Awasthi Solution

- MS Chauhan Solution

- LA Sena Solution

- Integral Calculus Amit Agarwal Solution

- IA Maron Solution

- Hall & Knight Solution

- Errorless Solution

- Pradeep's KL Gogia Solution

- OP Tandon Solutions

- Sample Papers

- Previous Year Question Paper

- Important Question

- Value Based Questions

- CBSE Syllabus

- CBSE MCQs PDF

- Assertion & Reason

- New Revision Notes

- Revision Notes

- Question Bank

- Marks Wise Question

- Toppers Answer Sheets

- Exam Paper Aalysis

- Concept Map

- CBSE Text Book

- Additional Practice Questions

- Vocational Book

- CBSE - Concept

- KVS NCERT CBSE Worksheets

- Formula Class Wise

- Formula Chapter Wise

- Toppers Notes

- Most Repeated Question

- Diagram Based Question

- Study Planner

- Competency Based Questions

- JEE Previous Year Paper

- JEE Mock Test

- JEE Crash Course

- JEE Sample Papers

- JEE Toppers Notes

- JEE Formula

- JEE Important Question

- JEE Mind Map

- JEE Integer-Numerical Type Question

- JEE Study Planner

- Important Info

- SRM-JEEE Previous Year Paper

- SRM-JEEE Mock Test

- VITEEE Previous Year Paper

- VITEEE Mock Test

- BITSAT Previous Year Paper

- BITSAT Mock Test

- Manipal Previous Year Paper

- Manipal Engineering Mock Test

- AP EAMCET Previous Year Paper

- AP EAMCET Mock Test

- COMEDK Previous Year Paper

- COMEDK Mock Test

- GUJCET Previous Year Paper

- GUJCET Mock Test

- KCET Previous Year Paper

- KCET Mock Test

- KEAM Previous Year Paper

- KEAM Mock Test

- MHT CET Previous Year Paper

- MHT CET Mock Test

- TS EAMCET Previous Year Paper

- TS EAMCET Mock Test

- WBJEE Previous Year Paper

- WBJEE Mock Test

- AMU Previous Year Paper

- AMU Mock Test

- CUSAT Previous Year Paper

- CUSAT Mock Test

- AEEE Previous Year Paper

- AEEE Mock Test

- UPSEE Previous Year Paper

- UPSEE Mock Test

- CGPET Previous Year Paper

- BCECE Previous Year Paper

- JCECE Previous Year Paper

- LPU Mock Test

- Crash Course

- Previous Year Paper

- NCERT Based Short Notes

- NCERT Based Tests

- NEET Sample Paper

- NEET Toppers Notes

- NEET Formula

- NEET Important Question

- NEET Assertion Reason Question

- NEET Study Planner

- Previous Year Papers

- Quantitative Aptitude

- Numerical Aptitude Data Interpretation

- General Knowledge

- Mathematics

- Agriculture

- Accountancy

- Business Studies

- Political science

- Enviromental Studies

- Mass Media Communication

- Teaching Aptitude

- Verbal Ability & Reading Comprehension

- Logical Reasoning & Data Interpretation

- CAT Mock Test

- CAT Important Question

- CAT Vocabulary

- CAT English Grammar

- MBA General Knowledge

- CAT Mind Map

- CAT Study Planner

- CMAT Mock Test

- SRCC GBO Mock Test

- SRCC GBO PYQs

- XAT Mock Test

- SNAP Mock Test

- IIFT Mock Test

- MAT Mock Test

- CUET PG Mock Test

- CUET PG PYQs

- MAH CET Mock Test

- MAH CET PYQs

- NAVODAYA VIDYALAYA

- SAINIK SCHOOL (AISSEE)

- Mechanical Engineering

- Electrical Engineering

- Electronics & Communication Engineering

- Civil Engineering

- Computer Science Engineering

- CBSE Board News

- Scholarship Olympiad

- School Admissions

- Entrance Exams

- All Board Updates

- Miscellaneous

- State Wise Books

- Engineering Exam

Maharashtra State Board Solutions Class 12 Secretarial Practice

FREE PDF Download

SHARING IS CARING If our Website helped you a little, then kindly spread our voice using Social Networks. Spread our word to your readers, friends, teachers, students & all those close ones who deserve to know what you know now.

Maharashtra Board Solutions Class 12 Secretarial Practice

Secretarial Practice is an important subject that Maharashtra State Board class 12 students need to study till they gather all the fundamental knowledge of the subject. Hence, to help students study Secretarial Practice properly here we have provided the links to download Maharashtra State Board Solutions Class 12 Secretarial Practice PDF.

These class 12 Secretarial Practice solutions Maharashtra board are prepared by our Secretarial Practice experts keeping in mind the prescribed Syllabus of Class 12 Maharashtra Board .

Students referring to these Secretarial Practice solutions can easily answer all those questions that appear challenging to them. Our Secretarial Practice experts have tried their best to make all the Maharashtra State Board Solutions Class 12 Secretarial Practice easy to understand.

Maharashtra Board Class 12 Secretarial Practice Solutions Download PDF

As mentioned above, how easy it is to answer challenging Secretarial Practice questions with the help of Maharashtra Board Class 12 Secretarial Practice Solutions. Therefore, Maharashtra Board Class 12 Secretarial Practice Solutions in PDF are provided by Selfstudys here. To help students to learn, practice, revise and solve all types of Secretarial Practice questions with ease.

By downloading the Maharashtra Board Class 12 Secretarial Practice Solutions in PDF, a student can score higher marks in the subject, they can cover their whole syllabus quickly and revise all the important topics time and again.

Not only this but, the Secretarial Practice solution class 12 Maharashtra board that we are providing here are free to use and download.

Benefits of Maharashtra State Board Solutions Class 12 Secretarial Practice

Any Maharashtra state board student who has taken Secretarial Practice in their class 12 needs to study the whole topics one by one. Along with that they need to check how much they have learned for MSBSHSE Class 12 Secretarial Practice exam and that is why Maharashtra state board solutions class 12 Secretarial Practice are considered beneficial. Here are the list of Benefits of Maharashtra State Board Solutions Class 12 Secretarial Practice:-

- Easy To Comprehend The Questions Its Answers

The Maharashtra board class 12 Secretarial Practice solutions are easy to understand and that is why students referring to the solutions can easily comprehend the approaches (step-by-step) required to solve the class 12 Secretarial Practice solutions of Maharashtra board.

- Ideal To Complete The Maharashtra State Board Class 12 Secretarial Practice Syllabus

There are several chapters in Maha Class 12 Secretarial Practice, now studying those chapters before the final board exam is a priority for all the Maha state board students. In that case the use of Maharashtra State Board Solutions Class 12 Secretarial Practice helps the students to Complete The Maharashtra State Board Class 12 Secretarial Practice Syllabus.

- Assists In Revising The Topics Of Class 12 Maharashtra Board Secretarial Practice

Secretarial Practice topics need a time to time revision but the revision process requires a separate time slot and Maha class 12 Revision Notes. However, referring to the Maharashtra state board class 12 Secretarial Practice solutions, a student doesn't need to reserve the time separately as they can revise the topics Of Class 12 Maharashtra Board Secretarial Practice along with solving them.

- Supports Competitive Exam Preparation

Apart from Maha Class 12 Secretarial Practice Board exam, there are various competitive exams where questions are asked from Secretarial Practice, in that case those students who have used Maharashtra state board solutions class 12 Secretarial Practice can develop a good grasp in the subject and perform better in the competitive exam. Hence, we can say that Maharashtra board class 12 Secretarial Practice solutions supports competitive exam preparation.

- Teaches How To Write Better Answers To Score High Marks

Writing Secretarial Practice answers in the board examination is an art. Writing answers of Class 12 Secretarial Practice in an organised and presentable manner leaves impressions on the teacher who checks them. Hence, referring to the class 12 Secretarial Practice solution Maharashtra board. It teaches how to write better answers to score high marks. The subject experts have used their expertise in writing the answers and so students can learn it to follow the same in their answer sheet as well as while solving Maha Class 12 Secretarial Practice Model Question Papers.

- NCERT Solutions for Class 12 Maths

- NCERT Solutions for Class 10 Maths

- CBSE Syllabus 2023-24

- Social Media Channels

- Login Customize Your Notification Preferences

- Second click on the toggle icon

"Log in, submit answer and win prizes"

"Enter your details to claim your prize if you win!"

Provide prime members with unlimited access to all study materials in PDF format.

Allow prime members to attempt MCQ tests multiple times to enhance their learning and understanding.

Provide prime users with access to exclusive PDF study materials that are not available to regular users.

Thank you for participating in Quiz Time!

Results Announcement on: coming Monday

Stay tuned: we’ll update you on your result via email or sms..

Good luck, and stay tuned for exciting rewards!

Maharashtra Board Class 12 Secretarial Practice Solutions Chapter 1 Introduction to Corporate Finance

Balbharti Maharashtra State Board Class 12 Secretarial Practice Solutions Chapter 1 Introduction to Corporate Finance Textbook Exercise Questions and Answers.

Maharashtra State Board Class 12 Secretarial Practice Solutions Chapter 1 Introduction to Corporate Finance

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1. _____________ is related to money and money management. (a) Production (b) Marketing (c) Finance Answer: (c) Finance

Question 2. Finance is the management of _____________ affairs of the company. (a) monetary (b) marketing (c) production Answer: (a) monetary

Question 3. Corporation finance deals with the acquisition and use of _____________ by business corporation. (a) goods (b) capital (c) land Answer: (b) capital

Question 4. Company has to pay _____________ to government. (a) taxes (b) dividend (c) interest Answer: (a) taxes

Question 5. _____________ refers to any kind of fixed assets. (a) Authorised capital (b) Issued capital (c) Fixed capital Answer: (c) Fixed capital

Question 6. _____________ refers to the excess of current assets over current liabilities. (a) Working capital (b) Paid-up capital (c) Subscribed capital Answer: (a) Working capital

Question 7. Manufacturing industries have to invest _____________ amount of funds to acquire fixed assets. (a) huge (b) less (c) minimal Answer: (a) huge

Question 8. When the population is increasing at a high rate, certain manufacturers find this as an opportunity to _____________ business. (a) close (b) expand (c) contract Answer: (b) expand

Question 9. The sum of all _____________ is gross working capital. (a) expenses (b) current assets (c) current liabilities Answer: (b) current assets

Question 10. _____________ means mix up of various sources of funds in desired proportion. (a) Capital budgeting (b) Capital structure (c) Capital goods Answer: (b) Capital structure

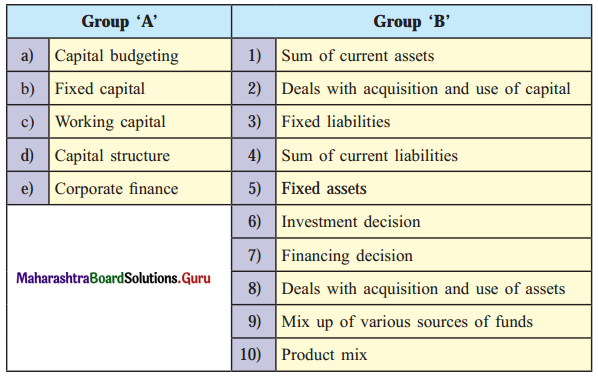

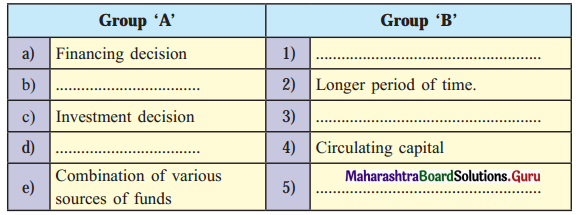

1B. Match the pairs:

1C. Write a word or term or a phrase that can substitute each of the following statements:

Question 1. A key determinant of the success of any business function. Answer: Finance

Question 2. The decision of the finance manager ensures that the firm is well-capitalized. Answer: Financing decision

Question 3. The decision of the finance manager to deploy the funds in a systematic manner. Answer: Investment decision

Question 4. Capital is needed to acquire fixed assets that are used for a longer period of time. Answer: Fixed capital

Question 5. The sum of current assets. Answer: Gross working capital

Question 6. The excess of current assets over current liabilities. Answer: Networking capital

Question 7. The process of converting raw material into finished goods. Answer: Production cycle

Question 8. The boom and recession cycle in the economy. Answer: Economic Trend

Question 9. The ratio of different sources of funds in the total capital. Answer: Capital Structure

Question 10. The internal source of financing. Answer: Retained earnings

1D. State whether the following statements are True or False:

Question 1. Finance is related to money and money management. Answer: True

Question 2. The business firm gives a green signal to the project only when it is profitable. Answer: True

Question 3. Corporate finance brings coordination between various business activities. Answer: True

Question 4. Fixed capital is also referred as circulating capital. Answer: False

Question 5. Working capital stays in the business almost permanently. Answer: False

Question 6. The business will require huge funds if assets are acquired on a lease basis. Answer: False

Question 7. The business dealing in luxurious products will require a huge amount of working capital. Answer: True

Question 8. A firm with large-scale operations will require more working capital. Answer: True

Question 9. Liberal credit policy creates a problem of bad debt. Answer: True

Question 10. Financial institutions and banks cater to the working capital requirement of the business. Answer: True

1E. Find the odd one.

Question 1. Land and Building, Plant and Machinery, Cash. Answer: Cash

Question 2. Debenture Capital, Equity Share Capital, Preference Share Capital. Answer: Debenture Capital

Question 3. Fixed Capital, Capital Structure, Working Capital. Answer: Capital Structure

1F. Complete the sentences.

Question 1. Initial planning of capital requirement is made by _____________ Answer: entrepreneur

Question 2. When there is boom in economy, sales will _____________ Answer: increase

Question 3. The process of converting raw material into finished goods is called _____________ Answer: production cycle

Question 4. During recession period sales will _____________ Answer: decrease

1G. Select the correct option from the bracket.

1H. Answer in one sentence.

Question 1. Define corporate finance. Answer: Corporate finance deals with the raising and using of finance by a corporation.

Question 2. What is fixed capital? Answer: Fixed capital is the capital that is used for buying fixed assets that are used for a longer period of time in the business eg. Capital for plant and machinery etc.

Question 3. What is working capital?/Define working capital. Answer: Working capital is the capital that is used to carry out day-to-day business activities and takes into consideration all current assets of the company. Eg: for building up inventories.

Question 4. What is the production cycle? Answer: The process of converting raw material into finished goods is called the production cycle.

Question 5. Define capital structure. Answer: Capital structure means to mix up various sources of funds in the desired proportion. To decide capital structure means to decide upon the ratio of different types of capital.

1I. Correct the underlined word and rewrite the following sentences.

Question 1. Finance is needed to pay dividends to debenture holders. Answer: Finance is needed to pay interest to debenture holders.

Question 2. When there is a recession in the economy sales will increase. Answer: When there is a boom in the economy sales will increase.

Question 3. Share is an acknowledgment of a loan raised by the company. Answer: A debenture is an acknowledgment of a loan raised by a company.

Question 4. Equity shares carry dividends at a fixed rate. Answer: Preference shares carry dividends at a fixed rate.

2. Explain the following terms/concepts.

Question 1. Financing decision Answer: A financing decision is a right decision that is made by a finance manager of any corporation ensuring that the firm is well capitalized with the right combination of debt and equity, having access to multiple choices of sources of financing.

Question 2. Investment decision Answer: Investment decisions mean capital budgeting i.e. finding investments and deploying them successfully in the business for greater profits.

Question 3. Fixed capital Answer: Fixed capital is the capital that is used for buying fixed assets that are used for a longer period of time in the business. These assets are not meant for. resale. Examples of fixed capital are capital used for purchasing land and building, furniture, plant, and machinery, etc.

Question 4. Working Capital Answer: Working capital is the capital that is used to carry out day-to-day business activities. It takes into consideration all current assets, of the company. It also refers to ‘Gross Working Capital’. Examples of working capital are

- for building up inventories.

- for financing receivables.

- for covering day-to-day operating expenses.

3. Study the following case/situation and express your opinion.

1. The management of ‘Maharashtra State Road Transport Corporation’ wants to determine the size of working capital.

Question (a). Being a public utility service provider will it need less working capital or more? Answer: MSRTC being a public utility service provider will need less working capital because of a continuous flow of cash from there, customers thus liabilities are taken care of.

Question (b). Being a public utility service provider, will it need more fixed capital? Answer: Being a public utility service provider MSRTC will need a huge amount of funds to acquire fixed assets thus it will need more fixed capital.

Question (c). Give one example of a public utility service that you come across on a day-to-day basis. Answer: The Indian Railways.

2. A company is planning to enhance its production capacity and is evaluating the possibility of purchasing new machinery whose cost is ₹ 2 crore or has alternative of machinery available on a lease basis.

Question (a). What type of asset is machinery? Answer: Machinery is a Fixed Asset. A fixed asset may be held for 5, 10 or 20 years and more. But if assets are acquired on a lease or rental basis, then less amount of funds for fixed assets will be needed for business.

Question (b). Capital used for the purchase of machinery is fixed capital or working capital. Answer: Capital used for the purchase of machinery is fixed capital.

Question (c). Does the size of a business determine the fixed capital requirement? Answer: Yes. Where a business firm is set up to carry on large-scale operations, its fixed capital requirements are likely to be high.

4. Distinguish between the following.

Question 1. Fixed Capital and Working Capital Answer:

5. Answer in brief:

Question 1. Define capital structure and state its components. Answer: Definition: R.H. Wessel “The long term sources of funds employed in a business enterprise.” John H. Hampton “A firm’s capital structure is the relation between the debt and equity securities that make up the firm’s financing of its assets.” Thus, the term capital structure means security mix. It refers to the proportion of different securities raised by a firm for long-term finance.

Components/Parts of Capital Structure: There are four basic components of capital structure. They are as follows: (i) Equity Share Capital:

- It is the basic source of financing activities of the business. Equity share capital is provided by equity shareholders.

- They buy equity shares and help a business firm to raise necessary funds. They bear the ultimate risk associated with ownership.

- Equity shares carry dividends at a fluctuating rate depending upon profit.

(ii) Preference Share Capital:

- Preference shares carry preferential rights as to payment of dividends and have priority over equity shares for return of capital when the company is liquidated.

- These shares carry dividends at a fixed rate.

- They enjoy limited voting rights.

(iii) Retained earnings:

- It is an internal source of financing.

- It is nothing but ploughing back of profit.

(iv) Borrowed capital: It comprises of the following:

- Debentures: A debenture is an acknowledgment of a loan raised by the company. The company has to pay interest at an agreed rate.

- Term Loan: Term loans are provided by the bank and other financial institutions. They carry fixed rate of interest.

Question 2. State any four factors affecting fixed capital requirements? Answer: (i) Nature of business:

- The nature of business certainly plays a role in determining fixed capital requirements. They need to invest a huge amount of money in fixed assets.

- e.g. Rail, road, and other public utility services have large fixed investments.

- Their working capital requirements are nominal because they supply services and not the product.

- They deal in cash sales only.

(ii) Size of business: The size of a business also affects fixed capital needs. A general rule applies that the bigger the business, the higher the need for fixed capital. The size of the firm, either in terms of its assets or sales, affects the need for fixed capital.

(iii) Scope of business: Some business firms that manufacture the entire range of their production would require a huge investment in fixed capital. However, those companies that are labour intensive and who do not use the latest technology may require less fixed capital and vice versa.

(iv) Extent of lease or rent: Companies who take their assets on a lease basis or on a rental basis will require less amount of funds for fixed assets. On the other side, firms that purchase assets will naturally require more fixed capital in the initial stages.

Question 3. What are Corporate Finance and State’s two decisions which are basic of corporate finance? OR Write short note on Corporate Finance Answer: Corporate finance deals with the raising and using of finance by a corporation. It includes various financial activities like capital structuring and making investment decisions, financial planning, capital formation, and foreign capital, etc. Even financial organisations and banks play a vital role in corporate financing.

Henry Hoagland expresses, “Corporate Finance deals primarily with the acquisition and use of capital by the business corporation”.

Following two decisions are the basis of corporate finances: (i) Financing decision: Every business firm must carefully estimate its capital needs i.e. working capital and fixed capital. The firm needs to mobilize funds from the right sources also maintaining the right combination of debt capital and equity capital. For this balance, a company may go for or raise equity capital or even opt for borrowed funds by way of debentures, public deposits term loans, etc. to raise funds.

(ii) Investment decision: Once the capital needs are accessed, the finance manager needs to take correct decisions regarding the use of the funds in a systematic manner, productively, using effective cost control measures to generate high profits. Finding investments through proper decisions and using them successfully in business is called ‘capital budgeting

6. Justify the following statements.

Question 1. The firm has multiple choices of sources of financing. Answer:

- Business firms require finance in terms of working capital and fixed capital.

- Funds are required at different stages of business.

- The company can raise funds from various sources i.e. from internal and external sources.

- Internal sources could be cash inflows on sales turnover, income from investments, and retained earnings.

- External sources can be obtained for short-term requirements through cash credit, overdraft trade credit, discounting bills of Exchange issues of commercial paper, etc.

- For long-term needs, a firm can meet its financing needs through the issue of shares, debentures, bonds, public deposits, etc. Thus, it is rightly said that the firm has multiple choices of sources of financing.

Question 2. There are various factors affecting the requirements of fixed capital. Answer:

- Fixed capital being long-term capital is required for the development and expansion of the company.

- The nature and size of a business have a great impact on fixed capital. Manufacturing businesses require huge fixed capital whereas trading organizations like retailers require less fixed capital.

- Methods of acquiring assets on rentals or on a lease/installment basis will require less amount of fixed assets.

- If fixed assets are available at low prices and concessional rates then it would reduce the need for investment in fixed assets.

- International conditions and economic trends like a boom period will require high investment in fixed assets and a recession will lead to less requirement.

- Similarly, consumer preferences, competition, and highly demanded goods and services will require a large amount of fixed capital. E.g. Mobile phones. Thus, it is rightly said that there are various factors affecting the requirements of fixed capital.

Question 3. Fixed capital stays in the business almost permanently. Answer: Factors determining fixed capital requirements are:

- Fixed capital refers to capital invested for acquiring fixed assets.

- These assets are not meant for resale.

- Fixed capital is capital used for purchasing land and building, furniture, plant, and machinery, etc.

- Such cap al is usually required at the time of the establishment of a new company.

- Existing companies may also need such capital for their expansion and development, replacement of equipment, etc.

- Modern industrial processes require the increased use of heavy automated machinery. Thus, it is rightly said that fixed capital stays in the business almost permanently.

Question 4. Capital structure is composed of owned funds and borrowed funds. Answer:

- Capital structure means to mix up of various sources of funds in desired proportions.

- To decide capital structures means to decide upon the ratio of different types of capital.

- A firm’s capital structure is the relation between the debt and equity securities that make up the firm’s financing of its assets.

- The capital structure is composed of own funds which include share capital, free serves, and surplus, and borrowed funds which represent debentures, bank loans, and long-term loans provided by financial institutions.

- Thus capital structure = Equity share capital + preference share capital + reserves + debentures.

- Thus, it is rightly said that capital structure is composed of owned funds and borrowed funds.

Question 5. There are various factors affecting the requirement of working capital. Answer:

- The nature and size of a business affect the requirement of working capital. Trading or merchandising firms and big retail enterprises need a large amount of capital compared to small firms which need a small amount of working capital.

- If the period of the production cycle is longer then the firm needs more amount of working capital. If the manufacturing cycle is short, it requires less working capital.

- During the boom period sales will increase leading to increased investment in stocks, thus requiring additional working capital and during the recession, it is vice versa.

- Along with the expansion and growth of the firm or company in terms of sales and fixed assets, the requirement of working capital increases.

- If there is proper coordination, communication, and co-operation between production and sales departments then the requirement of working capital is less.

- A liberal credit policy increases the possibility of bad debts and in such cases, the requirement of working capital is high, whereas a firm making cash sales requires less working capital.

7. Answer the following questions.

Question 1. Discuss the importance of Corporate Finance? Answer: Corporate finance deals with the raising and utilizing of finance by a corporation. It also deals with capital structuring and making investment decisions, financial planning of capital, and the money market. The finance manager should ensure that: The firm has adequate finance and it’s being utilized effectively; Generate minimum return for its owners.

The importance of Corporate Finance are as follows: (i) Helps in decision making: Most important decisions of business enterprises are made on the basis of availability of funds, as without finance any function of business enterprise is difficult to be performed independently. Obtaining the funds from the right sources at a lower cost and productive utilization of funds would lead to higher profits. Thus corporate finance plays a significant role in the decision-making process.

(ii) Helps in raising capital for a project: A new business venture needs to raise capital. Business firms can raise funds by issuing shares, debentures, bonds or even by taking loans from the banks.

(iii) Helps in Research and Development Research and Development need to be undertaken by firms for growth and expansion of business and to enjoy a competitive advantage. Research and development mostly involve lengthy and detailed technical work for the execution of projects. Through surveys and market analysis etc. companies may have to upgrade old products or develop new products to face competition and attract consumers. Thus the availability of adequate finance helps to generate high efficiency.

(iv) Helps in the smooth running of the business firm: A smooth flow of corporate finance is important to pay the salaries of employees on time, pay loans, and purchase the required raw materials. At the same time finance is needed for sales promotion of existing products and more so for the launch of new products effectively.

(v) Brings co-ordination between various activities: Corporate finance plays a significant role in the coordination and control of all activities in an organization. Production activity requires adequate finance for the purchase of raw materials and meeting other day-to-day financial requirements for the smooth running of the production unit. If the production increases, sales will also increase by contributing the income of the concern and profit to increase.

(vi) Promotes expansion and diversification: Corporate finance provides money for the purchase of modern machines and sophisticated technology. Modern machines and technology help to improve the performance of the firm in terms of profits. It also helps the firm to expand and diversify the business.

(vii) Managing risk: Companies have to manage several risks such as sudden fall in sales, loss due to natural calamity, loss due to workers strikes, change in government policies, etc. Financial aids help in such situations to manage such risks.

(viii) Replace old assets: Assets like plants and machinery have become old and outdated over the years. Finance is required to purchase new assets or replace the old assets with new assets having new technology and features.

(ix) Payment of dividend and interest: Finance is needed to pay the dividend to shareholders, interest to creditors, bank, etc.

(x) Payment of taxes/fees: The company has to pay taxes to the government such as Income tax, Goods and Service Tax (GST), and fees to the Registrar of Companies on various occasions. Finance is needed for paying these taxes and fees.

Question 2. Discuss the factors determining working capital requirements? Answer: Working Capital = Current Assets – Current Liabilities. In other words, it is also called ‘Circulating Capital’. Also, refer to ‘GROSS WORKING CAPITAL.’ Management needs to determine the size of working capital with reference to the economic environment and other aspects within the business firm.

Factors determining/influencing working capital requirements are as follows: (i) Nature of Business: The working capital requirements are highly influenced by the nature of the business. Trading/ merchandising forms concerned with the distribution of goods require a huge amount of working capital to maintain a large stock of the variety of goods to meet customers’ demands are extend credit facilities to attract them. Whereas public utility concerns have to maintain small working capital because of a continuous flow of cash from their customers.

(ii) Size of business: The size of a business also affects the requirements of working capital. Size of the firm refers to the scale of operation i.e. a firm with large scale operations will require more working capital and vice versa.

(iii) Volume of Sales: The volume of sales and the size of the working capital have a direct relationship with each other. If the volume of sales increases there is an increase in the amount of working capital.

(iv) Production cycle: The process of converting raw material into finished goods is called the ‘production cycle’. If the production cycle period is longer, the firm needs more amount of working capital. If the manufacturing cycle is short, it requires less working capital.

(v) Business cycle: When there is a boom in the economy, sales will increase resulting in to increase in investment in stock. This will require additional working capital. During a recession period, sales will decline and consequently, the need for working capital will also decrease.

(vi) Terms of purchases and sales: If credit terms of purchase are favourable and terms of sales are less liberal, then the requirement of cash will be less. Thus, the working capital requirement will be reduced. A firm that enjoys more credit facilities needs less working capital. On the other hand, if a firm does not get proper credit for purchases and adopts a liberal credit policy for sales if requires more working capital.

(vii) Credit Control: Credit control includes the factors such as volume of credit sales, the terms of credit sales, the collection policy etc. A firm with a good credit control policy will have more cash flow reducing the working capital requirement. Whereas if the firm’s credit policy is liberal there would be more requirements of the working capital.

(viii) Growth and Expansion: Those firms which are growing and expanding at a rapid pace need more working capital compared to those firms which are stable in their growth.

(ix) Management ability: The requirement of working capital is reduced if there is proper coordination in the production and distribution of goods. A firm stocking on heavy inventory calls for a higher level of working capital.

(x) External factors: If the financial institutions and banks provide funds to the firm as and when required, the need for working capital is reduced.

Maharashtra Board Class 12 Secretarial Practice Solutions Chapter 2 Sources of Corporate Finance

Balbharti Maharashtra State Board Class 12 Secretarial Practice Solutions Chapter 2 Sources of Corporate Finance Textbook Exercise Questions and Answers.

Maharashtra State Board Class 12 Secretarial Practice Solutions Chapter 2 Sources of Corporate Finance

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1. ___________ is the smallest unit in the total share capital of the company. (a) Debenture (b) Bonds (c) Share Answer: (c) Share

Question 2. The benefit of Depository Receipt is ability to raise capital in ___________ market. (a) national (b) local (c) international Answer: (c) international

Question 3. ___________ are residual claimants against the income or assets of the company. (a) Bondholders (b) Equity shareholders (c) Debenture holders Answer: (b) Equity shareholders

Question 4. ___________ participate in the management of their company. (a) Preference shareholders (b) Depositors (c) Equity shareholders. Answer: (c) Equity shareholders

Question 5. ___________ shares are issued free of cost to existing equity shareholders. (a) Bonus (b) Right (c) Equity Answer: (a) Bonus

Question 6. The holder of preference share has the right to receive ___________ rate of dividend. (a) fixed (b) fluctuating (c) lower Answer: (a) Fixed

Question 7. Accumulated dividend is paid to ___________ preference shares. (a) redeemable (b) cumulative (c) convertible Answer: (b) Cumulative

Question 8. The holder of ___________ preference shares has the right to convert their shares into equity shares. (a) cumulative (b) convertible (c) redeemable Answer: (b) Convertible

Question 9. Debenture holders are ___________ of the company. (a) creditors (b) owners (c) suppliers Answer: (a) creditors

Question 10. ___________ is paid on borrowed capital. (a) Interest (b) Discount (c) Dividend Answer: (a) Interest

Question 11. Debenture holders get fixed rate of ___________ return on their investment. (a) interest (b) dividend (c) discount Answer: (a) interest

Question 12. Convertible debentures are converted into ___________ after a specific period. (a) equity shares (b) deposits (c) bonds Answer: (a) equity shares

Question 13. Retained earnings are ___________ source of financing. (a) internal (b) external (c) additional Answer: (a) internal

Question 14. The holder of bond is ___________ of the company. (a) secretary (b) owner (c) creditor Answer: (c) creditor

Question 15. Company can accept deposits from public, minimum for ___________ months. (a) six (b) nine (c) twelve Answer: (a) six

Question 16. Company can accept deposits from public maximum for ___________ months. (a) 12 (b) 24 (c) 36 Answer: (c) 36

Question 17. A depository receipt traded in ___________ is called American Depository Receipt. (a) London (b) Japan (c) USA Answer: (c) the USA

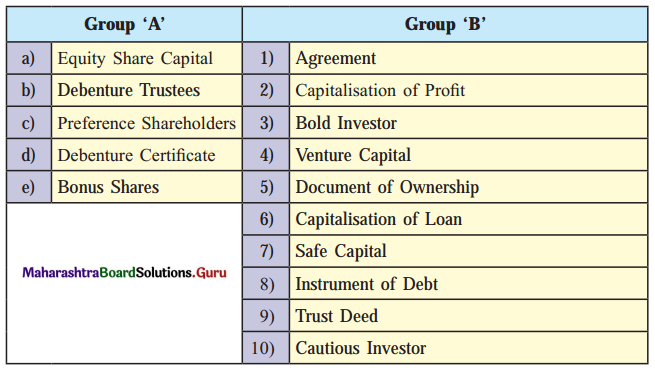

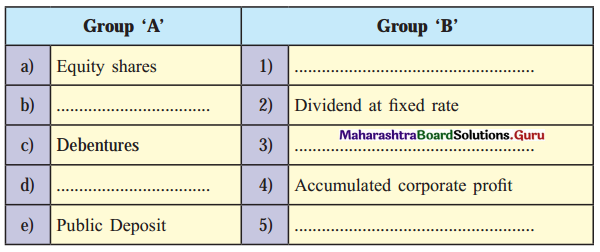

1B. Match the pairs.

1C. Write a word or a term or a phrase that can substitute each of the following statements.

Question 1. The real masters of the company. Answer: Equity shareholders

Question 2. A document of ownership of shares. Answer: Share certificate

Question 3. The holders of these shares are entitled to participate in surplus profits. Answer: Participating preference shares

Question 4. A party through whom the company deals with debenture holders. Answer: Debenture trustees

Question 5. Name the shareholder who participates in the management. Answer: Equity shareholders

Question 6. The value of a share is written on the share certificate. Answer: Face value

Question 7. The value of a share is determined by demand and supply forces in the share market. Answer: Market value

Question 8. The policy of using undistributed profit for the business. Answer: Retained earnings/ploughing back of profit

Question 9. It is an acknowledgment of a loan issued by the company to the depositor. Answer: Deposit receipt

Question 10. A dollar-denominated instrument trader in the USA. Answer: American Depository Receipt

Question 11. The Depository Receipt is traded in a country other than the USA. Answer: Global depository receipt

Question 12. Money raised by the company from the public for a minimum of 6 months to a maximum of 39 months. Answer: Public Deposits

Question 13. Credit extended by the suppliers with an intention to increase their sales. Answer: Trade Credit

Question 14. The credit facility is provided to a company having a current account with the bank. Answer: Overdraft

1D. State Whether the following statements are True or False.

Question 1. Equity share capital is known as venture capital. Answer: True

Question 2. Equity shareholders enjoy a fixed rate of dividends. Answer: False

Question 3. Debenture holders have the right to vote at a general meeting of the company. Answer: False

Question 4. Equity shareholders are described as ‘shock absorbers’ when a company has a financial crisis. Answer: True

Question 5. Bondholders are owners of the company. Answer: True

Question 6. Cash credit is given against hypothecation of goods and security. Answer: True

Question 7. Trade credit is a major source of long-term finance. Answer: False

Question 8. Depository bank stores the shares on behalf of the GDR holder. Answer: True

Question 9. Financial institutions underwrite the issue of securities. Answer: True

1E. Find the odd one.

Question 1. Debenture, Public Deposit, Retained Earnings Answer: Retained earnings

Question 2. Face value, Market value, Redemption value Answer: Redemption value

Question 3. Share certificate, Debenture certificate, ADR Answer: ADR

Question 4. Trade credit, Overdraft, Cash credit Answer: Trade credit

1F. Complete the sentences.

Question 1. The finance needed by business organisation is termed as ___________ Answer: Capital

Question 2. The convertible preference shareholders have a right to convert their shares into ___________ Answer: Equity shares

Question 3. Equity shareholders elect their representative Called ___________ Answer: Directors

Question 4. Bonus shares are issued as gift to ___________ Answer: Equity share holders

Question 5. The bondholders are ___________of the company. Answer: Creditors

Question 6. Depository receipt traded in a country other than USA is called ___________ Answer: Global Depository Receipt

Question 7. First Industrial policy was declared in the year ___________ Answer: 1948

Question 8. When goods are delivered by the supplier to the customer on the basis of deferred payment is called as ___________ Answer: Trade credit

1G. Select the correct option from the bracket.

(Fluctuating rate of dividend, Preference shares, Interest at fixed rate, Retained earnings, short term loan) Answer:

1H. Answer in one sentence.

Question 1. What is a share? Answer: A share is the smallest unit of the share capital of a company.

Question 2. What are equity shares? Answer: Equity shares are shares that do not preference shares and do not carry priority in receiving dividends nor repayment of capital.

Question 3. What are preference shares? Answer: Preference shares are shares that have preferential rights with regard to receiving dividends and repayment of capital.

Question 4. What are retained earnings? Answer: A part of the net profit which is not distributed to shareholders as dividend but retained by the company as reserve fund is retained earnings.

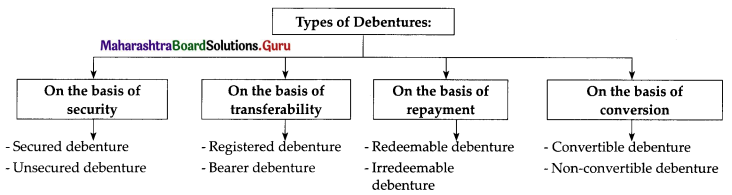

Question 5. What is a debenture? Answer: It is a document/instrument issued in the form of a debenture certificate under the common seal of the company acknowledging/evidencing the debt.

Question 6. What is a bond? Answer: A bond is a debt security and a formal contract to repay borrowed money with interest.

Question 7. In which country can ADR be issued? Answer: ADR (American Depository Receipt) is a depository Receipt that is issued in the USA.

Question 8. In which country can GDR be issued? Answer: GDR (Global depository receipt) can be issued in countries other than the USA.

Question 9. What are convertible debentures? Answer: Convertible debentures are debentures that are converted into equity shares after a specific period as specified at the time of issue.

Question 10. What are cumulative preference shares? Answer: Cumulative preference shares are shares where dividend, if not paid in a year accumulates till it is paid.

1I. Correct the underlined words and rewrite the following sentences.

Question 1. Owned capital is temporary capital. Answer: Owned capital is permanent capital.

Question 2. Equity shares get dividends at a fixed rate. Answer: Equity shares get dividends at fluctuating rates.

Question 3. Preference shares get dividends at fluctuating rates. Answer: Preference shares get dividends at a fixed rate.

Question 4. Retained earnings are an external source of finance. Answer: Retained earnings are an internal source of finance.

Question 5. The debenture holder is the owner of the company. Answer: The debenture holder is a creditor of the company.

Question 6. Bond is a source of short-term finance. Answer: Bond is a source of long-term finance.

Question 7. Depository receipt traded in the USA is called Global Depository Receipt. Answer: Depository receipt traded in the USA is called American Depository Receipt.

2. Explain the following terms/Concepts.

Question 1. Borrowed capital Answer:

- It consists of capital that is raised through borrowings.

- It can be raised by issuing debentures, deposits, loans from banks or financial institutions.

Question 2. Owned capital Answer:

- Owned capital is the capital raised by the company with the help of owners (shareholders).

- It can be raised by issuing equity and preference shares.

Question 3. Ploughing back of profit Answer:

- Ploughing back of profit or retained earnings is a management policy under which all profits are not distributed amongst shareholders.

- It is an internal source of financing or self-financing as when the need arises, such reserves are ploughed back, brought into the business to meet the financial needs.

Question 4. Overdraft Answer:

- It is a credit agreement made with a bank that allows an account holder to withdraw more money than what a company has in its account up to a specific/prescribed limit.

- This facility is available to current account holders.

Question 5. Trade Credit Answer:

- Trade credit is credit extended by one trader to another when goods and services are bought/sold on credit.

- It facilitates the purchase of supplies without making an immediate payment.

- It is used by business organisations as a source of short-term financing and granted to those having reasonable standing and goodwill.

3. Study the following case/situation and express your opinion.

1. The Balance sheet of a Donald Company for the year 2018-19 reveals equity share capital of Rs. 25,00,000 and retained earnings of Rs. 50,00,000.

Question (a). Is the company financially sound? Answer: The company is financially sound as it has double the amount as reserves or retained earnings or kept aside profits.

Question (b). Can the retained earnings be converted into capital? Answer: Yes, the retained earnings can be converted into capital by means of capitalisation of reserves.

Question (c). What type of source retained earning is? Answer: Retained earning is self-financing or an internal source of finance.

2. Mr. Satish is a speculator. He desires to take advantage of the growing market for the company’s products and earn handsomely.

Question (a). According to you, which type of share Mr. Satish will choose to invest in. Answer: As Mr. Satish is a speculator, he will choose equity shares to invest in because if there are good earnings/profits, so will be the rate of dividend.

Question (b). What does he receive as a return on investment? Answer: He receives a fluctuating rate of dividends.

Question (C). State anyone, right he will enjoy as a shareholder. Answer: The right to attend the meeting and vote on resolutions can be the right Mr. Satish can exercise as a member.

3. Mr. Rohit, an individual investor, invests his own funds in the securities. He depends on investment income and does not want to take any risk. He is interested in the definite rate of income and safety of the principal.

Question (a). Name the type of security that Mr. Rohit will opt for. Answer: As Mr. Rohit does not want to take risks, he will opt for preference shares which will assure him of steady income and safety of his investment.

Question (b). What does he receive as a return on his investment? Answer: Mr. Rohit will receive dividends in return.

Question (c). The return on investment which he receives is fixed or fluctuating. Answer: The return on his investment will be fixed and not fluctuating.

4. Distinguish between the following.

Question 1. Equity Shares and Preference Shares Answer:

Question 2. Shares and Debentures Answer:

Question 3. Owned Capital and Borrowed Capital Answer:

5. Answer in brief:

Question 1. What is a public deposit? Answer:

- Public deposit is an important source of financing short-term requirements of the company.

- Companies generally receive public deposits for a period ranging from 6 months to 36 months.

- Interest is paid by the companies on such deposits.

- The company issues a’ Deposit Receipt’ to the depositor.

- The receipt is an acknowledgment of debt/loan by the company.

- Deposits are either secured or unsecured loans offered by a company.

- It is considered a risky investment but investors can earn high returns on public deposits.

Advantages of deposits to the company

- It is an easier method of mobilizing funds during periods of credit squeeze.

- The rate of interest payable by the company on public deposits is lower than the interest from banks and financial institutions.

- It helps the company to borrow funds from a larger segment and thus, reduces dependence on financial institutions.

Question 2. What are Global Depository Receipt and American Depository Receipt? Answer:

- The shares that are issued by public limited companies are traded in various share markets.

- In India, shares are traded in the Bombay Stock Exchange (BSE) National Stock Exchange (NSE), etc.

- Similarly, Shares are traded in foreign stock exchanges like NYSE (New York Stock Exchange) or NASDAQ (National Association of Securities Dealers Automated Quotation).

- Companies that cannot list directly on foreign stock exchange get listed indirectly using GDR & ADR.

- GDR and ADR are Dollar/Euro denominated instruments traded on stock exchanges of foreign countries and are depository receipts containing a fixed number of shares.

- The Depository Receipts which are traded in the USA are called ADRs and Depository Receipts which are traded in all foreign countries other than the USA are called GDR.

- Indian Companies raise equity capital in the international market through GDR and ADR.

- Companies issue shares to an intermediary called ‘depository’.

- Bank of New York, Citigroup, etc act as Foreign Depository Bank.

- The Depository Banks issue GDRs or ADRs to investors against Indian Company’s shares.

- These ‘Depository Receipts’ are then, sold to foreign investors who wish to invest their savings in Indian Cost.

- The Depository Receipts are listed on the stock exchanges like regular shares.

- It is a depository bank that stores the shares on behalf of the receipt holder.

- NRI and foreign investors buy Depository Receipt Using their regular equity trading account.

- The company pays dividends in the home currency to the depository and the depository converts them into the currency of investor and pays dividends.

- Tata Motors and VSNL have ADRs.

- Bajaj Auto Limited ITC, L&T, Hindalco, Ranbaxy Laboratories, and SBI have GDRs.

- ADR allows the sale of securities only in the American market whereas GDR allows the sale of securities globally.

Question 3. What is Trade Credit? Answer:

- Every business requires trade credit and is common to all business types.

- Credit sales or granting of credit is inevitable in the present competitive business world.

- It is short-term financing to businesses.

- The small retailers, to a large extent, rely on obtaining trade credit from their suppliers.

- The cheapest method of financing; it is an easy kind of credit that can be obtained without signing any debt instrument.

- This is not a cash loan. It results from a sale of goods services which have to be paid sometime after the sale takes place.

- It is given by one trader to another trader to delay payment for goods and services involved in the transaction.

- Suppliers sell goods and willingly allow 30 days or more credit period for the bill to be paid.

- They offer discounts if bills are cleared within a short period such as 10 or 15 days.

- Such credit is given/granted to those having reasonable standing and goodwill.

Advantages of Trade Credit:

- Trade Credit is the cheapest and easiest method for raising short-term finance.

- It can be obtained without making any formal and written agreement or signing the same.

- It is readily available whenever goods and services are purchased on credit in bulk.

- It is free of cost source of financing.

- The terms of trade are lenient and not rigid.

Question 4. What are the schemes for disbursement of credit by banks? Answer: Meaning: Banks play an important role in terms of providing finance to the companies. They provide short-term finance for working capital, in the form of bank and trade credits.

The innovative schemes by banks for disbursement of credit are as follows: (i) Overdraft:

- A company having a current account with the bank is allowed an overdraft facility.

- The borrower can withdraw funds/overdraw on his current account up to the credit limit sanctioned by the bank.

- Any number of drawings up to the sanctioned limit is allowed for a stipulated term period.

- Interest is determined/calculated on the basis of the actual amount overdrawn.

- Repayments can be made during the time period.

(ii) Cash Credit:

- The borrower can withdraw the amount from his cash credit up to a stipulated/granted limit based on security margin.

- Cash credit is given against pledge or hypothecation of goods or by providing alternate securities.

- Interest is charged on the outstanding amount borrowed and not on the credit limit sanctioned.

(iii) Cash Loans:

- In this, the total amount of the loan is credited by the bank to the borrower’s account.

- Interest is payable on the actual outstanding balance.

(iv) Discounting bills of exchange:

- In the bill of exchange, the drawer of the bill (seller) receives money from the drawee (buyer) on the date or after the due date (the term mentioned in the bill).

- But due to discounting facility the drawer can receive money before the due date by discounting the bill with the bank (by giving the bill as security to the bank).

- The bank gives money to the drawer less than the face value of the bill (amount mentioned in the bill) after deducting a certain amount known as discounting charges.

- The bills are usually traded bills i.e. outcome of trade transactions.

- The bills are accepted by the banks and cash is advanced against them.

Question 5. State the features of bonds. Answer: Definition: According to Webster Dictionary, “a bond is an interest bearing certificate issued by a Government or business firm promising to pay the holder a specific sum at a specified date”. A bond is thus-

- A formal contract to repay borrowed money with interest.

- Interest is payable at a fixed internal or on the maturity of the bond.

- A bond is a loan.

- The holder is a lender to the company.

- He gets a fixed rate of interest.

Features: (i) Nature of finance:

- It is debt or loan finance.

- It provides long-term finance of 5 years, 10 years, 25 years, 50 years.

(ii) Status of investor:

- The bondholders are creditors.

- They are non-owners and hence, not entitled to participate in the general meetings.

- The bondholder has no right to vote.

(iii) Return on bonds:

- The bondholders get a fixed rate of interest.

- It is payable on maturity or at a regular interval.

- Interest is paid to the bondholder at a fixed rate.

(iv) Repayment:

- A bond is a formal contract to repay borrowed money.

- Bonds have a specific maturity date, on which the principal amount is repaid.

6. Justify the following statements:

Question 1. Equity shareholders are real owners and controllers of the company. Answer:

- They do not have special preferential rights as to dividends or returns of capital in the event of the winding-up of the company.

- They are joint owners and thus, have ownership rights.

- They have the right to participate in the management of the company and to vote on every resolution in the meetings thus, having exclusive voting rights.

- They use the right to vote to appoint directors, amend Memorandum of Association, Articles of Association, can remove directors appoint bankers, etc.

- Their shares bear ultimate risks associated with ownership.

- Thus, it is rightly said, that the equity shareholders are real owners and controllers of the company.

Question 2. Preference Shares do not carry normal voting rights. Answer:

- Preference shares enjoy priority or preference over equity shareholders as regards payment of dividends and repayment of capital.

- They carry a fixed rate of dividend.

- They do not take much risk as they are cautious investors.

- They attend class meetings if they have any problem affecting their interests or dividend is not paid to them for two or more consecutive years.

- As they do not take risks, they do not attend general meetings or take part in the management nor vote at the meetings.

- Thus, it is rightly said, that the preference shares do not carry voting rights.

Question 3. The debenture is secured by a charge on assets of the company. Answer:

- A debenture is a document that grants lenders a charge over a company’s assets giving them a means of collecting debt if a default occurs.

- The charges may be floating or fixed.

- A specific property is pledged as security.

- In case the debenture is not redeemed or exercised, the lenders can recover the cost by selling the fixed assets.

- Thus, it is rightly said, that the debenture is secured by a charge on assets of the company.

Question 4. Retained earnings are the simple and cheapest method of raising finance. Answer:

- Retained earnings is an internal source of financing used by established companies.

- Retained earnings is a kept aside profit by the company instead of distributing all the dividends to the shareholders.

- The accumulated profits are re-invested by the companies by issuing bonus shares.

- It does not create a charge on assets, nor dilute the shareholdings.

- Thus, it is rightly said, that the retained earnings also known as ploughing back of profit/capitalization of reserves/self-financing are the simple and cheapest methods of raising finance.

Question 5. Public deposit is a good source of short-term financing. Answer:

- Deposits can be accepted by the general public by public limited companies and not private limited companies.

- Deposits are accepted from the general public for a short term i.e. minimum 6 months and a maximum of 36 months or a 3-year term.

- The amount so raised is used for short-term financial requirements.

- The time of deposit is predetermined in advance and paid after the expiry of such period as per terms and conditions agreed.

- The depositors form the general public not necessarily equity shareholders.

- The administrative cost of deposits of the company is lower than that involved in the issue of shares and debentures.

- The rate of interest payable is lower than other loans. Thus, it is rightly said, that the public deposit is a good source for meeting short-term requirements.

Question 6. The bondholder is a creditor of the company. Answer:

- A bond is a debt security which the company borrows for long-term finance and issues certificates under its seal as acknowledgment.

- The owners get interested as a return on their investment which is decided and fixed at the time of issue.

- The interest payable to bondholders is a fixed charge and a direct expenditure.

- It has to be paid whether the company makes a profit or not.

- As the bondholders are creditors they do not have the right to attend meetings or participate in management.

- Thus, it is rightly said, that the bondholder is a creditor of the company.

Question 7. Trade credit is not a cash loan. Answer:

- Trade credit is a business-to-business agreement wherein there is an arrangement to purchase goods and services on credit and pays at a later date and not immediately.

- The credit period extends up to a month.

- Discount is given if the same is paid earlier.

- It is an interest-free loan given by one businessman to another.

- It does not involve loan formalities but only a trade transaction. Hence, not a cash loan.

- Thus, it is rightly said, that the trade credit is not a cash loan.

Question 8. Different investors have different preferences. Answer:

- Investors make different decisions and have different risk preferences when getting gains and losses.

- Educated ones may opt for capital markets as compared to others who may invest in gold or silver.

- Cautious investors are ready to have steady income rather than fluctuations.

- Risk-takers are ready to face the ups and downs of their invested money and on their returns.

- Active investors try to beat the market while passive track the market index.

- Thus, it is rightly said, that the different investors have different choices and preferences.

Question 9. Equity Capital is risk capital. Answer:

- Equity shareholders have a claim over residual proceeds of the company.

- In the event of winding up, they are the last to be paid off after setting the claims of creditors and external liabilities.

- They have fluctuating returns and risk of fluctuating market value.

- Equity capital is permanent capital and not refunded during the lifetime of the company.

- Not having any assurance as regards dividend, repayment of capital Equity Capital becomes risk capital.

- Thus, it is rightly said, that equity capital is risk capital.

7. Answer the following questions.

Question 1. What are a share and state its features? Answer:

- The term share is defined by section 2(84) of the Companies Act 2013 ‘Share means a share in the share capital of a company and includes stock.’ The capital of a company is divided into a large number of shares.

- It facilitates the public to subscribe to the company’s capital in smaller amounts.

- The share is thus, an indivisible unit of share capital.

- It is a unit by which the share capital is divided.

- The total capital is divided into small parts and each such part is called a share.

- The value of each part/unit is known as face value.

- A person can purchase any number of shares as and when he or she desires.

- A person who purchases shares of the company is known as a shareholder of the company.

- Generally, companies issue equity shares and preference shares in the market.

Features of shares: (i) Meaning:

- Share is the smallest unit in the total share capital of a company.

- The total share capital of a company is divided into small parts and each part is called a share.

(ii) Ownership:

- A share shows the ownership of the shareholder.

- The owner of the share is called a shareholder.

(iii) Distinctive number:

- Unless dematerialized, each share has a distinct number, which is noted in the share certificate.

- A share has a distinct number for identification.

(iv) Evidence of title:

- The company issues a share certificate under its common seal.

- It is a document of title of ownership of the share.

- A share is not a visible thing.

- It is shown by share certificate or in the form of ‘Demat share’

(v) Value of a share:

- Each share has a value expressed in terms of money.

- Face value: This value is written on the share certificate and mentioned in the Memorandum of Association.

- Issue Value: It is the price at which a company sells its shares. At par – equal to face value; At premium – more than the face value; At discount – Less than the face value.

(vi) Rights:

- A share confers/gives certain rights to the shareholders.

- Rights such as the right to receive dividends, right to inspect statutory books, right to attend shareholders’ meetings, right to vote in meetings, etc. (group rights), and right to receive notice, circulars, dividends, bonus shares, rights issue, etc. (individual rights).

(vii) Income:

- A shareholder is entitled to get a share in the net profit of the company.

- It is called a dividend.

(viii) Transferability:

- The shares of the public Ltd. company are freely transferable as per the rules laid down in the Articles of Association.

- Shares of a private company cannot be transferred.

(ix) Property of shareholder:

- A share is a movable property of a member.

- It can be transferred (gifted, sold) or transmitted (passed on to the legal heir after/due to death, insolvency or insanity of a member).

(x) Kinds of shares:

- A company issues two types of shares depending upon the right to control, income and risk.

- Equity shares – which do not carry preferential right to receive dividend or repayment of capital when the company winds up its activities.

- Preference shares – which carry preferential rights as regards dividend and repayment of capital in the event of winding up of the company.

Question 2. What is an equity share? Explain its features. Answer:

- Equity shares are the fundamental and basic source of financing activities of the business.

- Equity shares are also known as ordinary shares.

- Indian Companies Act 1956 defines equity shares as those shares which do not preference shares.

- The equity shares do not enjoy a preference in getting dividends.

Features of equity shares: (i) Permanent Capital:

- Equity shares are irredeemable shares. It is permanent capital.

- The amount received from equity shares is not refunded by the company during its lifetime.

- Equity shares become redeemable/refundable only in the event of the winding-up of the company or the company decides to buy back shares.

- Equity shareholders provide long-term and permanent capital to the company.

(ii) Fluctuating dividend:

- Equity shares do not have a fixed rate of dividend.

- The rate of dividend depends upon the amount of profit earned by the company.

- If a company earns more profit, the dividend is paid at a higher rate.

- If there is insufficient profit, the Board of Directors may postpone the payment of dividends.

- The shareholders cannot compel them to declare and pay the dividend.

- The dividend is thus, always uncertain and fluctuating.

- The income of equity shares is uncertain and irregular.

(iii) Rights:

- Equity shareholders enjoy certain rights.

- Right to share in profit when distributed as dividend.

- Right to vote by which they elect Directors, amend Memorandum, Articles, etc.

- Right to inspect books of account of their company.

- Right to transfer shares.

- Participation in management.

- Enjoy Right Issue and Bonus Issue.

(iv) No preferential right:

- Equity shareholders do not enjoy preferential rights in respect to the payment of dividends.

- They are paid dividends only after the dividend is paid to preference shareholders.

- At the time of winding up, they are the last claimants. They are paid last after all the other claims are settled.

(v) Controlling power:

- The control of a company vests in the hands of equity shareholders.

- They are often described as real masters of the company as they enjoy exclusive voting rights.

- Equity shareholders may exercise their voting right by proxies, without attending the meeting in person.

- The Act provides the right to cast vote in proportion to the number of shareholdings.

- They participate in the management of the company.

- They elect their representatives called the Board of Directors for management of the company.

- Equity shareholders bear maximum risk in the company.

- They are described as ‘shock absorbers when the company is in a financial crisis.

- The rate of dividend falls if the income of the company falls.

- The market value of shares goes down resulting in capital loss.

(vii) Residual claimants:

- A residual claim means the last claim on the earnings of the company.

- Equity shareholders are owners and they are residual claimants to all earnings after expenses, taxes, dividends, interests are paid.

- Even though equity shareholders are the last claimants, they have the advantage of receiving the entire earnings that are leftover.

(viii) No charge on assets:

- The equity share does not create any charge over the assets of the company.

- There is no security/guarantee of capital invested being returned.

(ix) Bonus issue:

- Bonus shares are issued as gifts to equity shareholders.

- They are issued ‘free of cost’.

- These shares are issued out of accumulated profits.

- These shares are issued to existing equity shareholders in a certain ratio or proportion of their existing shareholdings.

- Capital investment of equity shareholders grows on its own.

- This facility is available only to equity shareholders.

(x) Rights issue:

- Equity shareholders get the benefit of rights issues.

- When a company raises further capital by issue of shares, the existing shareholders are given priority to get newly offered shares, known as a rights issue.

(xi) Face value:

- The face value of equity share is very less.

- It can be ₹ 10 per share or even ₹ 1/- per share

(xii) Market value:

- Market value fluctuates, according to the demand and supply of shares.

- The demand and supply of equity shares depend on profits earned and dividends declared.

- When a company earns huge profits, the market value of shares increases.

- When it incurs a loss, the market value of shares decreases.

- There are frequent fluctuations in the market value of shares in comparison to other securities.

- Equity shares are more appealing to speculators.

(xiii) Capital Appreciation:

- Share capital appreciation takes place when the market value of share increases in the share market.

- The profitability and prosperity of a company enhance the reputation of the company in the share market and thus, facilitates appreciation of the market value of equity shares.

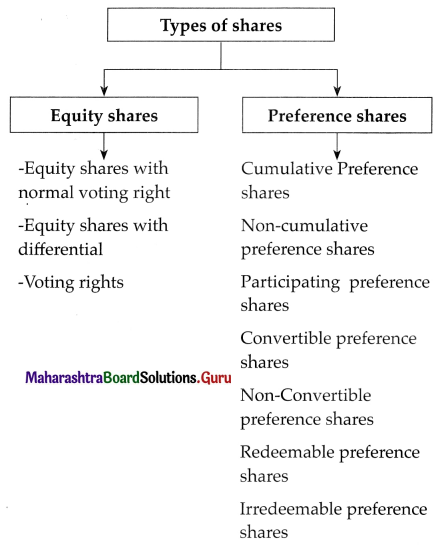

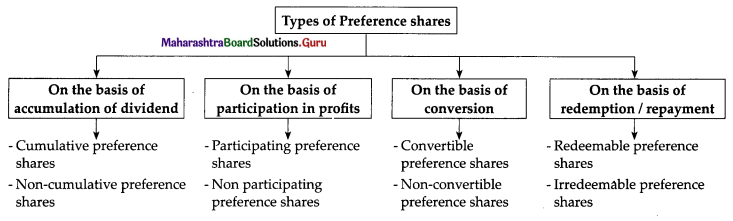

Question 3. Define preference shares/What are preference shares? What are the different types of preference shares? Answer:

- These shares have certain privileges and preferential rights such as to payment of dividends, return of capital, etc.

- Preference Share has which fixed rate of dividend is prescribed at the time of issue.

- The preference shareholders are co-owners but not controllers.

- They are cautious investors as they are interested in the safety of the investment.

(i) Cumulative Preference Shares:

- Cumulative preference shares are those shares on which dividend accumulates until it is fully paid.

- That is if the dividend is not paid in one or more years due to inadequate profit, then such unpaid dividend gets accumulated and is carried forward till next year.

- The accumulated dividend is paid when the company performs well.

- The arrears of dividends are paid before making payment to equity shareholders.

- The preference shares are always cumulative unless otherwise stated in Articles of Association.

(ii) Non-Cumulative Preference Shares:

- The dividend on these shares does not accumulate.

- That is the dividend on shares can be paid only out of profits of that particular year.

- The right to claim dividends will lapse if the company does not make a profit in that particular year.

- If the dividend is not paid in a year, it is lost.

(iii) Participating Preference Shares:

- The holders of these shares are entitled to participate in surplus profit besides preferential dividends. They participate in the high-profit condition of the company.

- Surplus profit here means excess profit that remains after making payment of dividends to equity shareholders.

- Such surplus profit up to a certain limit is distributed to preference shareholders.

(iv) Non-Participating Preference Shares:

- The preference shares are deemed to be non-participating if there is no clear provision in Articles of Association regarding participation in surplus profit.

- Such shareholders are entitled to receive a fixed rate of a dividend prescribed in the issue.

(v) Convertible Preference Shares:

- These shares have a right to convert their preference shares into equity shares.

- The conversion takes place within a certain agreed fixed period.

(vi) Non-Convertible Preference Shares:

- These shares are not converted into equity shares.

- They will remain as preference shares forever till paid back.

(vii) Redeemable Preference Shares:

- Shares that can be redeemed after a certain fixed period are called redeemable preference shares.

- A company limited by shares if authorized by Articles of Association issues redeemable preference shares.

- Such shares must be fully paid.

- The shares are redeemed out of divisible profit or out of the fresh issue of shares made for this purpose.

(viii) Irredeemable Preference Shares:

- Shares which are not redeemable are payable only on winding up of the company and are called irredeemable preference shares.

- As per section 55(1) of the Companies Act 2013, the company cannot issue irredeemable preference shares in India.

- Thus, are the types of preference shares.

Question 4. What are preference shares? State its features. Answer:

- The shares which carry preferential rights are termed preference shares.

- These shares have certain privileges and preferential rights such as payment of dividend, return of capital, etc.

- They prefer a steady rate of returns on investment.

Features of preference shares: (i) Preference for dividend:

- They have the first charge on the distributable amount of annual profits.

- The dividend is payable to preference shareholders before anything else is paid to equity shares, but after the settlement of dues of debentures, bonds and loans.

(ii) Prior repayment of capital:

- Preference shareholders have a preference over equity shareholders in respect of return of capital when the company is liquidated.

- It saves preference shareholders from capital losses.

(iii) Fixed return:

- These shares carry dividends at a fixed rate.

- The rate of dividend is predetermined at the time of issue.

- It may be in the form of a fixed sum or may be calculated at a fixed rate.

- The preference shareholders are entitled to dividends which can be paid only out of profit.

- Though the rate of dividend is fixed, the director in the financial crisis of the company may decide that no dividend be paid if there are no profits, the preference shareholders would have no claims for the dividend.

(iv) Nature of capital:

- Preference share capital is safe capital as the rate of dividend and market value do not fluctuate.

- Preference shares do not provide permanent share capital.

- They are redeemed after a certain period of time.

- It is generally issued at a later stage when a company gets established business.

- They are used to satisfy the need for additional capital of the company.

(v) Market value:

- The market value of preference shares does not change as the rate of dividend payable to them is fixed.

- The capital appreciation is considered to be low as compared with equity shares.

(vi) Voting right:

- The preference shares do not have normal voting rights.

- They have voting rights in matters that affect their interests – change of rights in terms of repayment of capital, or dividend payable to them are in arrears for two or more years.

(vii) Risk:

- Cautious investors generally purchase preference shares.

- Safety of capital and fixed return on investment are advantages attached with preference shares.

- These shares are a boon for shareholders during the depression when the interest rate is continuously falling.

(viii) Face value:

- The face value of preference shares is relatively higher than equity shares.

- They are normally issued at a face value of ₹ 100/-

(ix) Right or Bonus issue:

- Preference shareholders are not entitled to bonus or rights issues.